Between equipment, credit card fees, and handling physical cash, it can be a hassle. Thankfully, Square and PayPal make it easy to accept card payments using your smartphone or tablet. These advantages of electronic filing programs also send your customers' receipts, reconcile your transactions, and handle returns if necessary. Your method of collecting money is often referred to as your payment gateway.

Itemize all expenses by department.

This means that curiosity and deductive reasoning skills are also useful. You should have safe channels for transferring these documents so the data is safe from bad actors. If forensics bring up images of NCIS crime scenes, your deductive skills are up to par! Forensic accounting does require a certain degree of digging and detective work. Accurate invoicing is the key to getting paid in a timely and organized manner.

Free Financial Planning Templates

- Note that certain companies, such as those in service-based industries, may not have a lot of equity or may have negative equity.

- Stand firm and insist you receive payment for past orders before letting them have more materials or services.

- Perhaps you’re managing on your own for now but are considering expanding in the future.

- An accountant can use the data from your bookkeeper—along with payroll data and other records—to generate monthly financial statements, including the balance sheet and income statement.

When you get a good grasp of basic accounting and bookkeeping, you get a better understanding of your small business’s strengths and weaknesses. A chart of accounts lists all business transaction and is used to compile statements, review progress and locate transactions. These charts have to be updated often to include various business transactions.

Useful Accounting Tips for Small Businesses

It may struggle with a poor credit score, lack of funding, or difficulty fulfilling its working capital needs. As a small business owner, some of your business-related monies tend to get mixed in with your personal funds. The last thing you want to do is sit down and go through each and every shopping list or personal transaction to find specific business expenses. To prepare the system for the next accounting, temporary accounts that are measure periodically, including the income, expense and withdrawal accounts, are closed.

Accountants go beyond, advising leaders on what to do with this data. Once your business is registered and starts making transactions regularly, it’s time to prepare the bookkeeping system for your business. The financial books allow you to review your income and expenses, take control of your finances and make smart decisions. As a business owner or financial manager, keeping your company financially fit is a constant challenge. Effective accounting practices play a crucial role in achieving this goal, ensuring accurate financial records, informed decision-making and regulatory compliance.

Automate Invoicing

Whether you are documenting your monthly expenses, getting tax papers in order, or taking care of bills, organizing your accounting back-office is essential. Outsourcing your bookkeeping is another option, and this guide on how to find the best virtual bookkeeping service can help you get the process started. Your reports will look different depending on which you decide to use. We believe everyone should be able to make financial decisions with confidence. Lightspeed Accounting users spend on average five minutes a day on bookkeeping tasks that would previously take hours to complete manually.

However, when you see certain items such as a bank fee that you may not have recorded in your books, you will need to reconcile your records. Tracking and reviewing your income and expenses can help you assess the health of your business and plan for future growth. You can follow our guide contingent liability on how to make an income statement to accurately evaluate your business’s financial health. Keep a separate bank account for your personal and your business expenses. If you’re a solopreneur or independent contractor, chances are you’re responsible for everything, including the accounting.

If the nature of your business is seasonal, you can tailor different factors, like the frequency of your evaluation, to this cycle. For instance, you might require more reviews of your accounting process during high season and fewer during slower months. The frequency in which you review how to account for the value of finished goods inventory and evaluate your methods is bound to be unique to your specific business. However, it‘s normal (and recommended) to audit your process at the end of every month, quarter, and year. This way, nothing slips through the cracks or becomes a problem that’s too large to bounce back from.

As an accountant, you need to be able to offer timely suggestions and recommendations to your clients. Keep track of where information is for all of your different clients. That should include secure storage systems for all of their documents. If you’re an accountant, remember many of your clients will have the same deadlines.

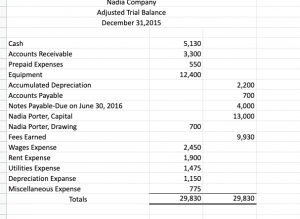

Once the adjusting entries are made, an adjusted trial balance must be prepared. This is done to test if the debits match the credits after the adjusting entries are made. This is the final step before the preparation of the business’ financial statements. More importantly, you can’t make informed business decisions if your accounting system produces bad data. You can’t evaluate the financial health of your business if your financial systems aren’t operating correctly.

Internal Revenue Service rules require businesses to maintain records for at least three years; accountants recommend seven years. If you don’t carry a receipt book with you everywhere you go, you can always rely on technology. Keep track of your cash using cloud software that links through multiple devices, like your phone or laptop. This way, your cash-tracking document or app is always readily accessible. You can use your streamlined online system to note how much cash is exchanged and why.

This will help you avoid having to outlay a significant amount of funds at the end of the year. How do you know if your business is losing money or profitable? Profit and loss statements is a recap of your business expenses, costs and revenues on specific dates. Getting acquainted with taxes and other accounting and booking aspects can be incredibly useful. You’ll be able to see what your accountants are doing and know exactly how much of your company’s money is going where.

“Even if you’re busy, stay in touch with your accounting team,” said Ethan Howell, co-owner of Florida Environmental. Partners who can help you with taxes, financial flow, budgeting, etc. Never be afraid to ask them to define a phrase they use in an email or document,” he said. Under the cash-basis method of accounting, you record income and expenses when cash transactions are done. For example, you record revenue for a product only when the customer pays you for the product. When you start a business, open a separate business bank account that will keep your business finances separate from your personal ones.