Have you been prepared to have a location to call the individual? Are you ready to invest in property you want? Really, up coming this piece is simply what you want now! This short article take you step-by-step through the whole process of tips get a home for yourself and with the best interest pricing, determined properly for the ICICI financial calculator. It can focus on the process, the necessity of a home loan and just how you may make sure that you could potentially fundamentally feel the fantasy house that you had usually need on your own!

Really, when you do need to own a property of, then there's something that you are going to need to do bundle. How will you go-about for the think region efficiently? Listed below are some tips that may absolutely assist you to set-out towards a planned highway:

- First of all you need to do is actually fix for the a resources for your home. How much cash do you want to invest on buying your the fresh new family otherwise block of land? Your own ft budget should determine what financing bundle you are going to opt to possess, just what ICICI lender financial interest do you actually must choose and after that.

EMI calculator available online

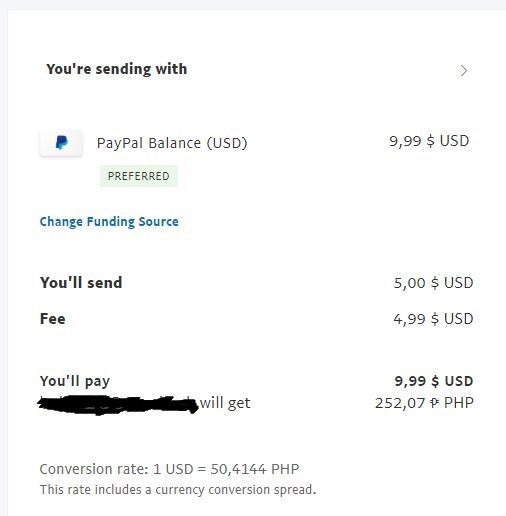

- The next thing that must be their believe is when much loan you are going to capture and you may what will become the fresh new EMI or the level of appeal that you will have to invest each month. This can be done with the help of an EMI calculator available on the net. Then you'll definitely need certainly to contrast you to definitely amount to see whether you are able to cover that matter every month, according to your existing income. Then you may consider continuing to the loan bundle you to definitely you are looking for.

- When you are finished with one to, and you've got used the ICICI bank home loan EMI calculator in order to develop a concept, you're going to have to seek their eligibility along with your credit score. Your credit score, which is conceived in accordance with the loans that you have taken previously and you will returned it, will tell you whether you are entitled to the loan bundle that you will be targeting. It is quite necessary to just remember that , for mortgage bundles, you will have to ensure that you was salaried otherwise has an income source that you can inform you.

- It is important to just remember that , you may have to generate a downpayment, which could not be included in your loan, that you would need to give your self. You will also have to spend membership percentage apart from the contribution you pay as a part of your own ICICI financial loan attention.

- Knowing most of these information, you might move ahead and also have your loan software over.

Loan bundles and you will rates from ICICI Lender

Really, if you wish to means a broad suggestion concerning the home loan rate of interest that's supplied by that it financial, then you can without difficulty try to do a little look into the ICICI bank home loan rate of interest 2019 and interest to be had now.

The attention pricing will always drifting and it will count on whether you're salaried, self-employed as well as the amount you are borrowing. Let me reveal a recent ICICI housing loan rate of interest which you might want to take note of:

ICICI Property Mortgage Interest

- If you find yourself a salaried staff member trying to get a loan Up in order to Rs. thirty-five lakhs your floating rate of interest would-be between RR + dos.95% (six.95%) RR + 3.60% (seven.60%)

- When you are a beneficial salaried employee applying for a loan between Rs. thirty-five lakhs Rs. 75 lakhs your floating interest rate would be ranging from RR + 3.20% (7.20%) RR + 3.eight5% (eight.75%)

- When you are a good salaried worker obtaining that loan above Rs. 75 lakhs your floating rate of interest would be between RR + step 3.30% (7.30%) RR + 3.95% (7.95%)

- Whenever you are care about-working trying to get a loan Doing Rs. 35 lakhs then your floating interest would be between RR + 3.20% (seven.20%) RR + step three.85% (eight.85%).

There'll be other ICICI financial home loan qualification and you may appeal rate if you sign up for a maintenance of your home from one loan amount.

Faq's

Ans. Sure, it will be easy to try to get that loan if you want to resolve your home. The eye rates are usually somewhere within RR + 3.10% (seven.10%) RR + 3.35% (seven.35%) to possess salaried staff and RR+3.25% (eight.25%) RR+step 3.50% (eight.50%) for those who are mind-functioning.

Ans. Sure, together with your financial rates of interest, you will also have to spend a home loan membership payment. Such, if you are obtaining financing out-of say Rs. 35 lakhs and your operating percentage would be step 1.75 lakhs. Therefore, that's a sum of cash you will have so you're able to features at hand, also payday loan Chunchula the fees which can connect with they.

Ans. Yes, you can lessen the rate of interest. Then you will need to take towards the a different lender and you can manage an equilibrium transfer to them and inquire these to remove the speed in general. You can also contact this new ex-financier while you are the financial, predicated on your residence loan qualification ICICI and then try to force to own a diminished rate of interest.